Welcome to the Sanford REI Buying/Selling Page! For the past 18 years as a real estate agent AND the past 11 years as a real estate broker here at Sanford REI, we were a full service real estate brokerage company helping Buyers and Sellers buy and sell real estate. We were also THE 1ST AND ONLY REAL ESTATE COMPANY IN CONNECTICUT THAT OFFERED A 20 MINUTE/$50 GUARANTEE THAT YOU COULD NOT FIND A BETTER DEAL WHEN BUYING OR SELLING IN CONNECTICUT and we challenged those Buyers and Sellers to go out and find 2 unrelated agents and ask them to bring their info and figures. Then call us and we would beat them! Well for 18 years, we did just that and I never had to pay out the $50 for the Challenge as I beat them every time! However, in March, 2025, I retired from the Real Estate Board in Connecticut as a full time Real Estate Broker. So now, I can help you full time saving money with issues that you may encounter with a bad agent, bad broker or issues you may have with inspections, mortgage commitments, appraisals and closing as a MENTOR or CONSULTANT but I cannot represent you in your real estate transaction as a real estate broker. PLEASE SEE MENTOR/CONSULT Tab for more information!

HIRING A REAL ESTATE AGENT: Hiring the right real estate agent/broker based on recommendations, response time, in-person interviews, track record and data support will yield that pricing expert you need, HOWEVER, do NOT hire an agent who will only give you pie charts, graphs, a few comps while agreeing with you that the price for your home that YOU want is correct even though the Comps say it may be worth less? Did you ever ask your agent to show you what your last property looked like on the MLS? Do you have any idea how much missed information you may be putting up with when you sell your home that exists??? Run these things by us in a 15 minute appointment and get some REAL piece of mind!

LET’S TALK COMMISSION: THIS WILL BE EYE OPENING! Did you know that if you agree to a 5% or 6% commission, that the agent you signed with SHOULD split it evenly but they may not being do so and there is no way for you to see what is going on with this unless you ask another realtor to look it up? Did you know if your realtor gives less than half of the commission to a buyer agent/broker, that those same buyer’s agents won’t even bring their buyers to your home to see it??? Then when your agent tells you, you are not getting enough showings because the price is too high (and it may be too high if that agent ALSO “bought the listing”) but your home may not be selling because your greedy ass agent is keeping more than half of the commission you agreed to and the buyer’s agents out there won’t take less than half and so they won’t bring buyers to your house! THIS is just ONE example of how your agent may be killing your sale!

COMPS DONE THE WRONG WAY: When buying a property, most agents only give you 1 thing – “Comps” which is short for “Comparables”. This a list of similar styled properties that sold/closed within the past year or so on the “MLS” or Multiple Listing Service and that’s it! The MLS is the database that all real estate agents use to buy and sell properties on the market. Here is how 95% of the real estate agents and brokers do it the wrong way:

- They will pull all Closed Properties near your Property without looking at closing dates so they are “stale”.

- Many of these Closed Properties will be more than 1-2 miles away and may even be in a different town/city.

- Some of these Closed Properties closed more than 90 days ago.

- Some of these Closed Properties are either the wrong house style or if the correct style, are 50 years older or newer than your property.

- They will NOT make any adjustments to the Closed Price for differences between the Closed/Comp house versus your house. So, for Example, if the Closed House had 1 additional full bathroom than your house, they would just leave it when they should be deducting $5,000 off of that Closed/Comp property!

- That is all these other agents give you! THIS IS NOT HOW YOU RUN COMPS! Yes, yes, yes, they may doctor up this information with useless pie charts and graphs but that is really all you are getting! What is worse is that they cannot even do this correctly as they either leave certain properties out of your Comp list (either on purpose or not), they use different style houses (which is the wrong way of doing it), use “Stale” Comps (meaning houses that sold months and months ago – which is also the wrong way of pulling Comps) or they only pull “Comps” that are close in price to the property you want to buy or sell so they don’t have to worry about putting in a low offer if you are the Buyer OR they will give you only the Comps that are close to the price YOU think your property is worth! BOTH ways are horrible and these agents do this to get you to just sign that contract! It is called “Buying a Listing” when it is done on the Seller side and the agent just wants your property as 1 of their listings so they will ask you what do you think your house is worth and then agree with you EVEN THOUGH they know the adjusted comps show your home is worth substantially less! It is completely unethical and yet it is done all of the time! Then, over time, the agent will stair step down the price lieing to you that the house is not selling because the price may be a little high when in fact, that agent knew the beginning sales price was way too high but they agreed with you because they just wanted the listing. They don’t care how much time and money you lost nor care how much it will aggravate you when it takes even longer to sell!

COMPS DONE THE RIGHT WAY: When buying a property, here is how 1-5% of the real estate agents and brokers do it the right way:

- They will pull all Closed Properties that are within 1-2 miles of your home.

- All of these Closed Properties will be in the same city as your home.

- All of these Closed Properties closed LESS than 90 days ago.

- All of these Closed Properties are either the same house style as yours and only if possible are within 30 years old of when your home was built. This one is not as important as the others so it is things we strive for.

- These very few Real Estate Agents/Brokers WILL MAKE monetary Adjustments to the Closed Price for differences between the Closed/Comp house versus your house. So, for Example, if the Closed House had 1 additional full bathroom than your house, they would deduct $5,000 off of that Closed/Comp property closing price! THEN they will make adjustments for so many other things like # of rooms, # of bathrooms, acreage, square feet, garages, basements, condition, etc!

- They will show you all initial Comp/Closed properties they pulled to show you the full range and then lay out the Properties they used to come up with the 3-4 Adjusted Comps!

MOST IMPORTANT THING MISSED BY 95% OF ALL REAL ESTATE AGENTS WHO ARE REPRESENTING A BUYER:

Ok so you think you found a property that is just right for you, you have driven by it to see if the neighborhood and exterior looks good too. You had a chance to at the inside too. It is time to put an offer in on this property. Most agents will advise a price based on “Comps” that were more than likely done the wrong way as described above. To make matters worse, then your agent will miss the most important thing to consider when putting in an offer as a Buyer and that is your agent never looked into how motivated the seller might be! Why do they do this? They lack the knowledge and experience I have to investigate the sellers to find out how motivated they are! THIS is where I used to DESTROY my competitors as I would investigate the Sellers to see how motivated they were because a Motivated Seller is a Seller who is willing to come down on price, be more flexible with terms and in some instances, may even consider an owner finance option too! Only about 1% of agents will look into what the Seller may be going through to see how motivated they are.

Your initial offer should be based on 3 things if you are buying your own Single family home: and the last thing is VITAL to getting the best possible deal! Most agents either don’t tell you, don’t fully understand or miss “C” completely!

(a) What you are pre-qualified for (what your Lender says you can afford through their Pre-Qualification to you) and what monthly rate you are comfortable with are 2 separate things! Just because you may be pre-qualified to buy up to $500,000 does NOT mean the monthly payment that goes along with buying a $500,000 home is a monthly payment that you feel ok with! So a great agent will go get these figures and go over whether your monthly payment is too high on spending more for the house!

(b) What the property is worth (based on real, accurate, recent and adjusted “Comps” and not what you think it’s worth) and

(c) The motivation of the seller.

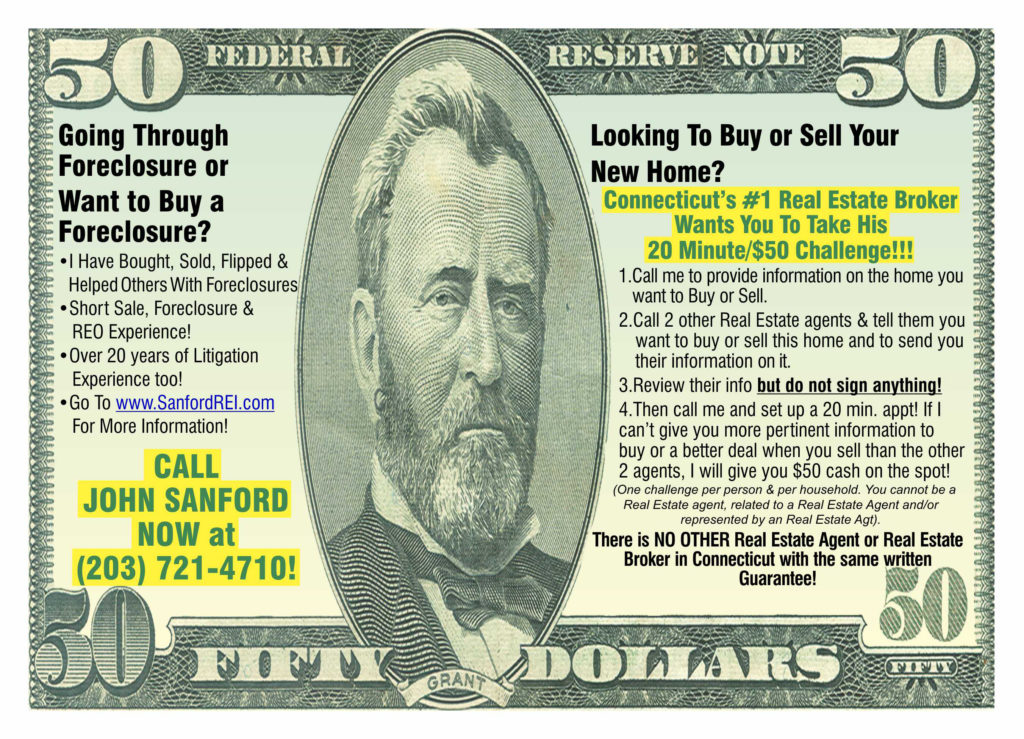

This giant post card below was the one I used for 18 years and I never once had to pay the $50! Check out tht Guarantee! Now, again, I retired as a Real Estate Broker here in Connecticut in March, 2025 but that does not mean I cannot be your real estate consultant when you have a Buying or Selling issue with agents, brokers, investors, inspections, appraisals etc!

Now let’s talk about down payments on your own Single Family Home. Many people think they need 10 or even 20% to put down on a property. Think again! You don’t need 20%!!! You normally don’t even need 10%!!! That’s right!

Let’s say you cannot get pre-qualified at this time. DON’T GIVE UP! John still has options for you! You can do a Lease Option, an Owner Finance or a Subject 2 on a property that may be on the market! You can get this in place while you repair your credit issues so you can get pre-qualified! Check out “Wholesaling and Lease Options” under the “Investing” tab at the top of the page for more information on those options!

Please complete the Contact Form if you need help with Buying or Selling your home. Again, I cannot represent you but for a a few bucks and a 15 minute call, we can hopefully help you resolve any real estate issue you may have right now!

Thanks again!

John Sanford – Managing Member and Real Estate Broker

Sanford Real Estate & Investment, LLC.

222 Main Street, Unit 223

Farmington, CT 06032